In June 2023, the Hong Kong retail fund market continued to register net inflows – the third month in a row – at US$173 million. In the first half of 2023, the industry registered aggregate net inflows of US$2.30 billion, a major improvement over the net outflows of US$3.96 billion registered during the same period last year.

Mr Nelson Chow, co-chair of the Unit Trust Subcommittee, said, “We are encouraged to see net inflow into the fund industry during the first half of 2023. Despite the challenging market environment, investors have identified areas of buying opportunities for the long term.”

Among the various fund categories, bond funds are the key contributors to the net inflows in the first half of this year. They attracted US$4.21 billion of inflows, offsetting the net outflows witnessed by the equities sectors (US$1.22 billion) and mixed assets (US$471 million), leaving the industry with an overall net total of US$2.301 billion.

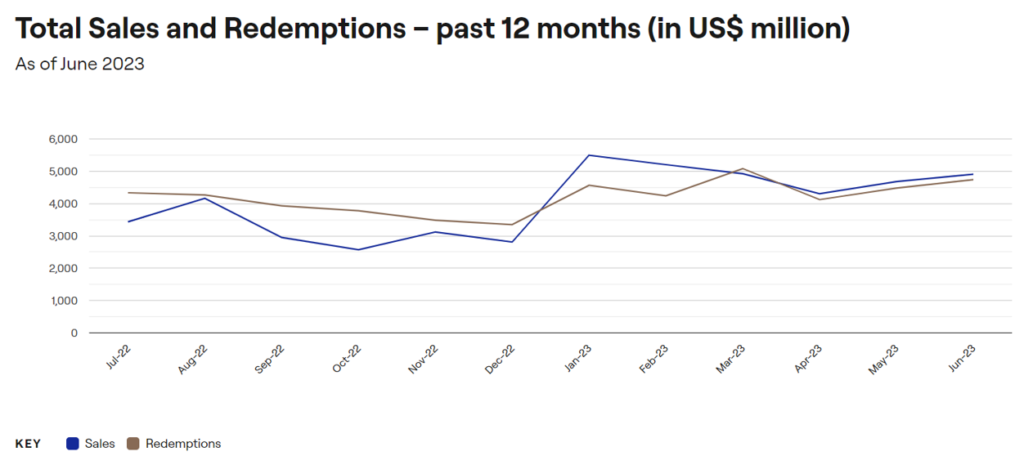

Gross sales in the Hong Kong retail fund market reached US$4.906 billion in June. This is in line with the trend since March, when monthly sales have been hovering between US$4 billion and US$5 billion. On an aggregate basis, YTD gross total reached US$29.512 billion.

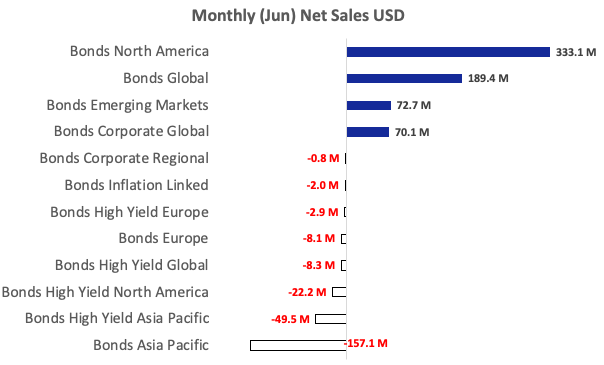

In June, bond funds continued to attract net inflows, though the level is more moderated than that of April and May. Furthermore, not all bond categories registered net inflows. Net inflows primarily concentrated in two categories, namely North America Bonds and Global Bonds. In total, they garnered US$522.5 billion net inflows, vs. the US$414.4 billion registered by the bond categories as a whole.

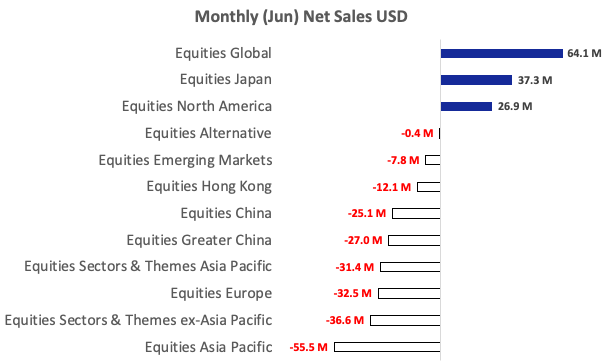

For equity funds, despite they managed to register gross inflows of US$1.3 billion in June, there were net outflows of approximately US$100 million. But net outflows were not across- the-board: Global, Japan and North America equity funds, managed to register net sales. On a YTD basis, China equities funds were the equity category that attracted the largest net inflows, at US$127.7 million.

In June, all mixed asset fund sectors saw net outflows – continuing the trend since March. On a YTD basis, mixed asset funds saw aggregate net outflows of US$470 million.

(End)