Frequently asked questions

Contents

Fund Investment

What is a unit trust or a mutual fund?

A unit trust or a mutual fund refers to a collective investment scheme under which professional fund managers pool money from individual investors and manage it according to pre-set investment objectives. The investment objectives can range from maximising capital gains to maintaining a stable stream of income, and from beating inflation to preserving capital. Based on the designated objectives, the fund manager will invest the money in equities, bonds, currencies or other relevant investment instruments in a specific market or different markets around the world.

Why should I invest in funds? What are the pros and cons?

Pros:

Low minimum investment, but with many choices: With a minimum investment, usually of US$1,000-US$2,000, you can invest in a wide array of securities through funds. For instance, an equity fund usually holds at least 40-50 stocks, and for some funds which have larger asset sizes, they may hold over a hundred stocks. If you buy all the individual stocks direct, especially the blue-chips, you would probably need a substantially larger outlay of capital. For bonds, you may find it extremely difficult to invest in individual bonds because the principal value is usually much higher.

Access to global investment opportunities: Through funds, your investment horizon can be broadened because there are different types of funds which can provide you with a very convenient and cost-effective way to capitalise on both local and overseas investment opportunities, and to avoid being bogged down in a particular market or by a particular type of instrument.

Diversification: Diversification may take different forms, e.g. along geographic or industry lines, or amongst different securities or issuers. The essence is that by investing in securities that have a low correlation, a portfolio can help you spread out the risks and achieve a better risk-return behaviour than individual securities.

The Code on Unit Trusts and Mutual Funds issued by the Securities and Futures Commission (“SFC”) (read the Section on “Investor protection”) has detailed requirements to ensure sufficient spread of investments.

For example, a fund cannot hold more than 10% of its net asset value in securities issued by a single issuer. Also, a fund cannot hold more than 10% of the ordinary shares issued by a single issuer.

Access to professional investment management services: Through funds, you can enjoy the services rendered by fund managers. Fund managers will help you research and analyse the markets and securities for the funds. Fund managers will determine which securities to hold, when to buy or sell. They make decisions based on extensive research into the performance of individual stock or other security issues, as well as the fundamentals of the economies and market trends. If you invest direct in a particular stock, you may need to spend a lot of time to monitor the performance and the latest development of individual stocks. However, with funds, you are relieved of these often onerous and time-consuming tasks of studying and picking specific securities. You can concentrate on your own occupation and other pursuits because there is a team of professional fund managers who will monitor the investment full-time.

Convenience: If you invest in individual stocks directly, you have to handle the custody and administration for each and every single stock. However, with funds, you enjoy a “one-stop” service as you can invest in a range of stocks, but can dispense with the tedious task of arranging payment, settlement and other related administration work for each individual stock. Also, it is relatively easy to buy funds. You can buy through banks, independent financial advisors or direct from fund houses.

Cons:

UNABLE TO PICK STOCKS?

Some people do not like to invest in funds because they enjoy the stock-picking process and they think that fund investment deprives them of the decision-making power to choose stocks. It should be noted that it is here where the value-added of fund investment lies: funds allow an investor to focus on his own work and let fund managers, who have the professional expertise and skills, take care of his investment on a full-time basis.

RISKIER THAN BANK DEPOSITS?

Relatively speaking, most fund types (except probably money funds) would be riskier than bank deposits. However, risks go hand-in-hand with returns, i.e. higher risks go with higher returns and vice versa. Over a longer term, you have the opportunity to get better returns from most fund types than from a normal bank savings account.

UNABLE TO KNOW THE FUND PRICE REAL-TIME?

Unlike stocks, when you buy or sell funds, you won’t know the price at which you buy or sell real-time. Most funds are dealt on a daily basis (though some specialist funds may deal on a weekly or monthly basis) using a forward pricing basis. This means that when you buy or sell or switch in or out of a fund, you do not know the buy/sell price at which the transaction will be executed until the next dealing day. The reason for this is that unlike an individual stock or bond, each fund holds a basket of securities. The price is calculated based on the net asset value of all the securities held and the number of outstanding units. The key benefit of using the “forward pricing” approach is that it is fair to all investors, as unit prices calculated after the dealing cut-off time on a particular day reflect the market value of the underlying investments more accurately.

ARE UNIT TRUSTS DIFFERENT FROM MUTUAL FUNDS?

From an investment perspective, there are no major differences between unit trusts and mutual funds. Both are governed by the SFC Code on Unit Trusts and Mutual Funds. Both are professionally managed portfolios which invest in a wide variety of financial instruments.

What types of funds are available?

Funds are commonly divided into the following categories, based on their investment objectives and policies:

- asset allocation

- equity

- fixed income/bonds

- money market

- warrants or derivatives

- others

What is an asset allocation fund?

It refers to a balanced portfolio that aims to provide both capital gains and income. This type of fund may invest in global equity, fixed interest and money market instruments; and usually the investment in a particular asset class does not exceed a certain percentage.

What is an equity fund?

It refers to a fund that primarily (usually not less than 70%) invests in equities with the aim of maximising capital gains. The type of equities invested can range from domestic to international; and from blue-chips to small companies shares.

What is a bond fund?

It refers to a fund that invests predominantly (usually not less than 70%) in bonds and other fixed income securities which can be issued by governments, municipal states, corporations, or other issuers.

What is a money market fund?

It refers to a fund that invests in short-term money market instruments (usually less than one year), such as government securities, term papers, bank deposits; and other assets denominated in different currencies. It is sometimes called cash fund, currency fund or reserve fund.

What is a warrant or derivatives fund?

A warrant fund typically invests in excess of 70% in warrants or related instruments and these funds may be highly geared. Apart from warrant funds, there are other derivatives funds that invest in geared financial instruments, such as futures, forward contracts and options to maximise capital appreciation.

What are the other types of funds?

Examples include:

- convertible bond funds – “convertible bonds” refers to an instrument which has an option to be converted into equities at some pre-determined date in the future. Convertible bond funds invest predominantly – usually not less than 70% – in convertible bonds and preference shares.

- guaranteed funds – it refers to funds that usually limit investors’ loss over a certain period, by way of a legally enforceable guarantee.

- fund of funds – this refers to a fund that invests in other funds, rather than investing directly in stocks, bonds or other securities.

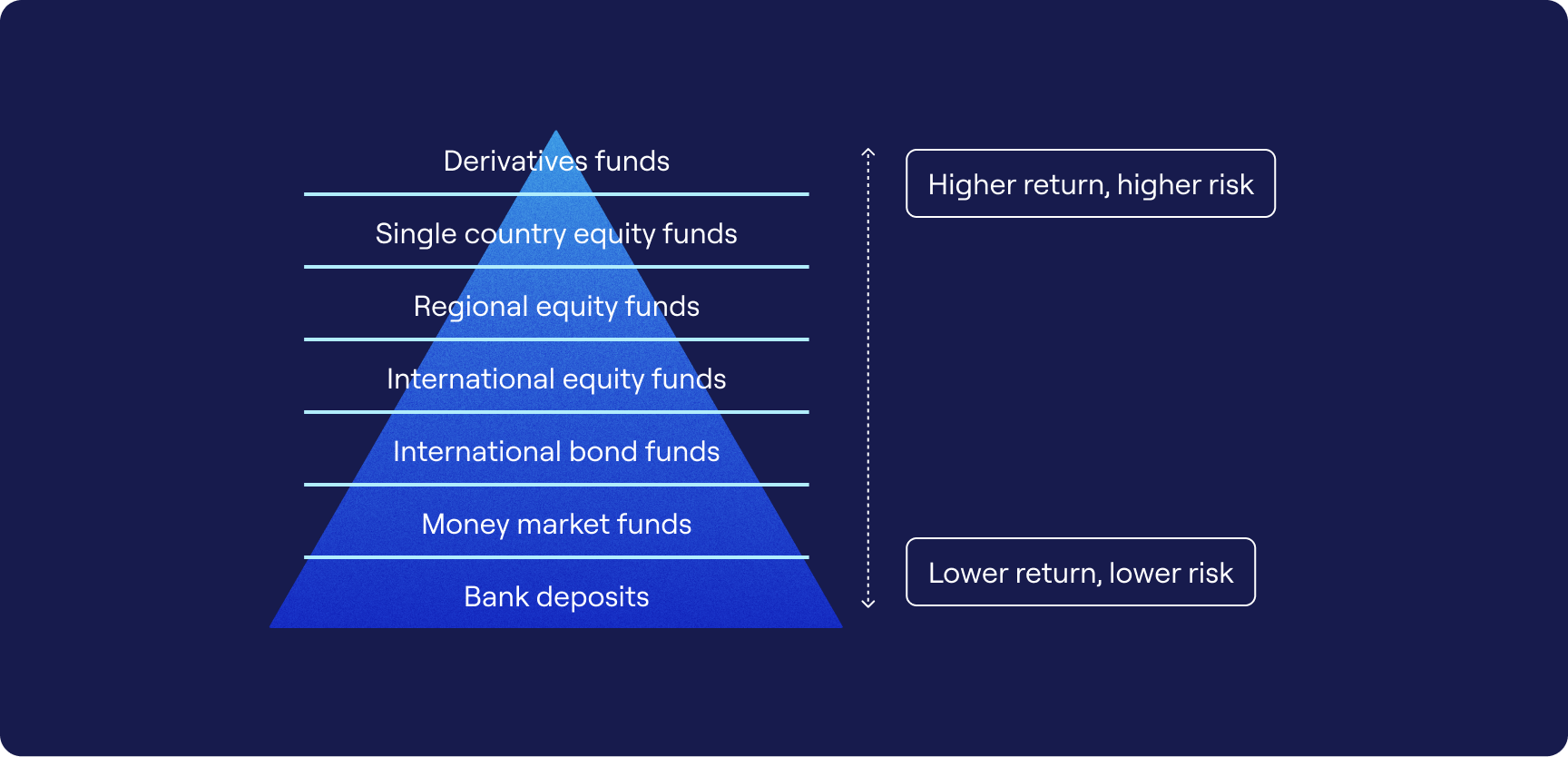

What sort of risks and returns can I expect for funds?

General – risk and return:

In making any investments, you should estimate both the returns and risks of the investment, bearing in mind that there is a trade-off between the two. In layman terms, risk is the chance of not achieving your objectives of your investment. This may mean losing money, failing to beat inflation, or underperforming a certain benchmark. This is very personal as different people have different objectives.

From a more “objective” basis, you can probably look at the volatility of your investment, through the standard deviation (“S.D.”). Usually, an investment with a higher S.D. is riskier.

Risks for each fund type:

Risks and returns vary with the types of funds. Generally speaking, higher risks go with higher returns and vice-versa; and risk appetites vary with an investor’s age, income and financial position, as well as his investment objectives and risk tolerance level.

a) Equity funds:

If you invest in an equity fund, you are basically exposed to the same type of risks of the underlying equities.

The risks of a stock can be:

- unsystematic: company-specific (e.g. a competitor introduces an innovative product, which boosts its market share substantially);

and/or

- systematic: applicable to the overall market (e.g. stock market crash of 1987) Through diversification, a fund portfolio can reduce the unsystematic risks substantially. In addition, like investing in any types of funds, you may be exposed to foreign currency fluctuations if the funds invest in overseas

b) Bond funds:

In essence, the risks you are exposed to in a bond fund are similar to that you would face if you invest in an individual bond:

- interest rate risk – when interest rates go down, bond prices usually go up and vice versa.

- default risk – this relates to the possibility of an issuer failing to pay interests or repay the principal.

- inflation risk – while bond funds may offer more stable returns than equity funds, their total returns may fail to keep pace with the inflation rate.

- prepayment risk – this happens when interest rates fall and the issuer may prepay before the bond matures.

The key difference between a bond fund and an individual bond is that the former does not have a maturity date and that its dividend payments are not fixed.

To choose a bond fund, you should check whether the fund focuses more on:

- maximising regular income streams (e.g. funds that invest in bonds issued by US or other more developed markets);

- maximising capital value rather than regular income inflows (e.g. high yield bonds); or

- striking a balance between the two.

c) Money market funds:

Compared with an equity or a bond product, money funds tend to provide a relatively high degree of safety. They are managed with the objective of maintaining the net asset values constant; whereas for other asset types, the net asset values may fluctuate. Typically, a money market fund invests in short-term and high quality deposits and debt securities. In other words, they are basically lending money only for brief periods to organisations such as banks, governments, and major corporations. As such, the risk of loss is relatively low. However, a money fund can be “risky” as it may fail to beat inflation in the long-run. This will mean that your money is worth less and less.

Due to its relatively stable characteristics, it is often used as a cash management account where you can earn money rates on the money you need to use very soon. Also, investors very often use money market funds as a “parking place”. This is especially common when there is much uncertainty about the investment outlook and they haven’t decided what investment options they should take up and when to invest; or when they feel that other options may look too risky.

MPF

What factors should employers consider when choosing an MPF service provider?

1. Product features

Information found in the Scheme’s Offering Documents can be used for comparison, including:

- Operations and principals of schemes

- Choice and objectives of constituent funds

- Investment policy and restrictions

- Fund valuation methods and frequency

- Restriction or flexibility of contributions, withdrawals, and switches

- Fees and charges

- Reports and accounts

- Notification requirements for participants and fund holders

2. Investment performance and expertise

Although past track record is not indicative of future performance, you can assess the credibility and capability of the fund manager by reviewing the consistency of similar funds managed by the fund manager.

3. Client servicing

Efficient administrative and client servicing support are essential to the smooth running of the scheme and keeping costs down.

4. Employee education

Initial and ongoing communication and education programs to employees on how MPF can help employees achieve their retirement goals, what type of MPF fund are suitable for their needs, and regular updates on fund managers’ latest investment performance and strategy.

What should employees consider when choosing MPF funds?

MPF is a defined contribution plan and the employee can select the appropriate fund(s) that best match his/her investment objective.

You may consider these personal circumstances when choosing a MPF fund:

Years to retirement

How many years will you be investing in MPF before you redeem your MPF portfolio at the retirement age of 65

You should consider the impact that inflation has on your retirement nest egg, and compounding effect that your investments will have over the long term

As a general guideline, the longer you have until retirement, the more risk you can afford to take and hence your portfolio can focus more on growth oriented equity funds

Likewise, the closer you are to retirement, you may wish to preserve your retirement nest egg and opt for a more conservative type fund focusing on bonds

Life cycle need

What are your priorities at various stages in life in relation to your investment goals

Especially relevant to your voluntary contributions

Retirement goal

How much do you need to enjoy a comfortable retirement

Risk tolerance

All investments have risks

Consider the investment objective and scope of the fund and how much the related price fluctuation is going to affect you

Again, one can normally afford to invest in growth oriented funds with a higher price volatility if one has a long term investment horizon

How will MPF provide for my retirement needs?

Employees should not rely solely on MPF to provide for their retirement needs – it is only one of the solutions to ensure financial security for the community in old age. It complements benefits paid out from Social Security and private savings.

For MPF to work successfully, there should be a relationship in which employers and employees work as partners in preparing for employees’ retirement.

Also, it requires employees to make informed decisions regarding contribution rates and asset allocation. These decisions have a direct impact on the level of money they can accumulate for retirement.

To ensure that they can make informed decisions, the industry and the providers should provide very extensive employee education, in particular to enable them to understand, among other things:

- what are the key sources of retirement income

- how to set goals for retirement income

- what is the effect of inflation on retirement buying power

- what is the implication of life style and expected life span on retirement income

What protection does MPF offer?

The MPF Ordinances and guidelines provide several layers of protection to protect members’ scheme assets.

- Safety Net, including trust structure, ensure separation of scheme assets

- capital and expertise requirements of trustees/service providers (not only initial, but also on-going proactive monitoring)

- internal control requirements

- professional indemnity insurance

- compensation fund

In addition:

- investment standards and restrictions on forbidden investment practices

- marketing activities, e.g. regulation of intermediaries, approval of marketing material, publish investment results

- remedies of non-compliance, e.g. indemnify losses, corrective and remedial action

How can employees assess capability of MPF fund managers?

HKIFA and other organisations have, on a regular basis, been publishing MPF performance data.

Apart from reviewing fund performance data, employees can look at the fund house’s investment expertise, in particular, its experience and track record in retirement fund management.

In addition, they can take reference from the performance of other types of funds, such as authorised funds, especially performance over a longer time frame, say over 3, 5, 10, 20 years. But it must be noted that these data can be used for reference only because:

- these funds’ investment objectives, policies as well as restrictions and guidelines may not be the same as those of the MPF;

- past performance data are not indicative of future performance.

Apart from returns, they should look at the volatility of the funds to have a more balanced picture.

(Note: At present, the HKIFA website has performance data of authorised funds.)